Online payments continue to gain momentum globally. In recent times, you have probably met numerous customers who have asked, “Is there a way to pay using my card?”. This applies if you have an online or physical store.

It’s time to think about how to set up your business to receive online payments. It is of essence that you provide your customers with more payment options or risk letting them walk away. Here’s how to go about accepting online payments.

Register a business name

You need to make your business a legal entity by registering it with the Corporate Affairs Commission. This action qualifies you to open a business account. If you wish to do it yourself, start with visiting CAC’s website and locate CAC’s Company Registration Portal. The next step is to check if the business name you have chosen is still available. Afterward, complete a pre registration form, upload the necessary documents and pay a filing fee. You can get an electronic copy of your certificate of registration once your filling has been processed and concluded. The other option is to hire a lawyer to handle the process for you at an extra fee. A Lawyer would also educate you about the options open to you and give professional advice that suits your business goals.

Open a business bank account

To accept cashless payments, your money needs to go somewhere. A business account becomes necessary to store payments that your business receives. It’s important to separate a personal account from your business account as it makes your business professional and helps you track your inflows and manage them better.

Find out what you need to open a business account from any local or international bank you hope to work with.

Typically, you need your CAC certificate, a valid ID, account signatory’s info, some cash deposits, and utility bills to open an account.

Embrace ecommerce and social commerce

If you have decided to accept online payments, You can begin to sell the ecommerce way or the social commerce way. You have the following options to pick from if you have to sell online:

- Social commerce platforms like Credomart offers you a customised shopping space on the web to display your products and organise inventory. As a stand alone platform, customers can visit your shop directly with a shared link and complete purchases. It is also designed to support your business pages on social media.

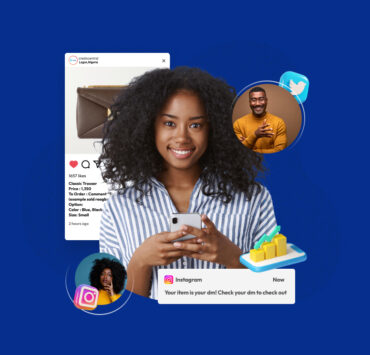

- Traditional social media platforms like Facebook, Instagram, Twitter and Whatsapp business are places you can reach your customers. You need to set up a business page and integrate smart tools to accept payments. Credo’s innovative comment selling feature enables social sellers close sales faster from the comment section of their posts on social media.

- Build your own ecommerce website optimised to carry out sales by including a cart and payment options so that customers can pay directly from your website

- The other option is to join an ecommerce platform. On ecommerce platforms you get an in-built store for yourself where you can display your products without any extra cost of setting up your own ecommerce website.

If you want to run a multichannel business, you can use more than one of them to increase your chances of reaching your buyers.

Get a payment gateway

With a payment gateway, you don’t need to invest in physical hardware or building softwares to accept and process payments. Gateways can process debit and credit card payments. Ordinarily, to be able to accept credit card payment for your business, you need a merchant account, and a payment processor. But you can skip all that because payment gateways create a merchant account for you backed with a payment processor.

Some all-in-one payment providers allow you accept multiple payment options in different currencies, automate payments , process payments, and get deposits in your business account. There is also the option of generating a payment link that you can share with customers to make payments.

Most e-commerce service providers have integrated a gateway that allows for easy checkouts. Even on social media the likes of Facebook and Instagram have this option available in some countries. In Nigeria however, this service isn’t yet available. Social Sellers in Africa can use Credo, to accept payments and use its comment selling feature to close sales faster on any social medium they choose.

How payment gateway works

When customers share their credit card info, the payment gateway secures this information. It then runs this information via a processor to be approved or declined. If approved, sales is completed and the gateway pays into your account as agreed.

During this process there is a communication chain that involves the payment gateway, the bank that issued the card and the card company to ascertain that the card is funded and all details shared are correct.

Some payment gateways support electronic bank transfers as well. Gateway services usually charge a fee if you choose to use them.

Be Security Compliant

Online merchants need to partner with a payment gateway that meets the standards of the Payment Card Industry Data Security Standards (PCI-DSS) . This is to ensure the safety of you and your customer’s money. Essentially, you should choose a payment gateway that stays up to date with these standards and operates by them.

Payment gateways offer multiple payment options and can be integrated to fit into the type of online store you hope to run. You also don’t have to worry about chargebacks as payment gateways help you manage all the baggage that comes with online payments.

We hope you found this article helpful. Say hello to us on our social media handles!

Credo on Twitter , Credo on Instagram, Credo on Linkedin, Credo on Facebook ,

Eclectic and evocative soundtrack

Rhythm gameplay

Tough challenge

Woefully out of place

Pacing slows

Exploration sequences feel drawn out