Adebunmi Wellington, Driving Business Growth in Africa With Smarter Payments

“Payment is payment, we were told, but is it? With the upsurge in online payments, do pain points still exist for customers, are they experiencing difficulties and suffering from starving payment needs? Our answer is a resounding yes!

Adebunmi Wellington, the Chief Visionary Officer and co-founder of Credo, is an admitted geek who enjoys everything gadget. She is a Product & Innovation Leader with extensive financial & information technology expertise. She has over twenty two years of experience leading and motivating high-performance teams to deliver innovations that solve people and business challenges. She has proven strengths in strategy building and transforming ideas and businesses into profitable entities.

She began her career as a Quality Assurance Analyst at AOL in its thriving years and climbed the ranks building teams and products along the way. She also worked at several industries and multinational organizations including some United States Government Agencies.

Despite being Stateside, she remained interested in the blossoming technology sector in Nigeria and lent her voice, ideas, time and skills to its advancement. Soon, love and the desire to instigate change and turn visions into realities saw her relocating to the country to pursue what she had always wanted for herself and her career.

Since returning to Nigeria, Adebunmi has been entrenched in the payment space. First, leading product development for the alpha mobile money & wallet operations, then eventually taking reins at the first indigenous payment technology firm in Nigeria where she led multiple product teams, birthing impactful products, some of which currently have large user bases. She currently serves as the Chief Visionary Officer at Credo, sits on several boards, and teaches her mentees weekly on products, career, entrepreneurship and technology at Product Dojo.

But she is far from being done.

Post COVID-19 and in digital economies where small businesses must survive, Adebunmi was inspired and challenged by her then boss to upgrade the typical and familiar card processing gateway.

Although she understood that the key to survival was creating a digital presence that outlives the uncertainties found in physical-only access, the question then became, hasn’t it all been done for payments? What beyond aesthetics and existing features can one take to the market?

Adebunmi got to work. Some Research. Some Digging. Some Surveys. Some Discussions. Bang! Light bulb! (Corny, yeah *emoji) There is a world of commerce that lives on Social Media but quite a messy one.

55% of the 41.5 million Micro, Small and Medium-size businesses are retail traders. A remarkable number of these almost-23 million people rely on social media to complete their trading activities but are constantly plagued by digital payment challenges; a single transaction requires as many as 4 or more different solutions (Social Media Network, Payment Solution, Communication channel etc) over multiple communication sessions and an untidy accounting and operation management system to be successful.

Armed with this insight, Adebunmi and her team developed the product idea.

Customers or aptly put people were at the heart of Credo from its inception. Consumers and merchants work hard for their money, and work harder to carry out basic daily transactions. At best, they are faced with the challenges of double debits, lengthy refunds, fraud, security, and still fretful, hence lower adoption rates.

It was confirmed, “payments isn’t just payments”. It is embedded in every human activity, whether work or play. A secure, personalized, and easy-to-use payment gateway will enhance lives and drive business growth in Africa.

Here comes Credo. The result of months of work.

Organisations of all sizes can receive payments with the Credo Gateway and every African can unleash the power of digital payments in a safe and secure space.

Yes, the public would argue that this space has been taken up, but we beg to differ. There is still a lot of work to be done. We need a payment gateway that can promise a flawless, faultless experience and accommodate the nuances across specialized verticals like Social Commerce.

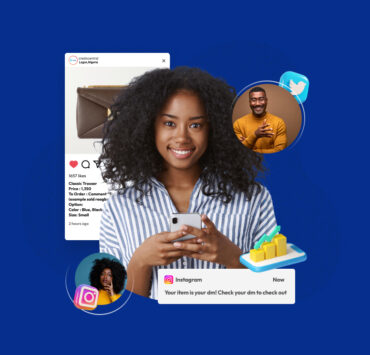

With Credo Social, merchants can access an intelligent and innovative way of accepting payments, track inventory and engage their customers in a single place. Its innovative comment selling features enables customers to initiate and complete a purchase directly from the comment section of a social media post with our special keyword, ‘Credodibs’.

The team is also fanatical about businesses delivering great customer experiences to their customers across all touchpoints. To reinforce this, Credo holds a monthly Live event where social sellers, consumers, and the public at large come together to talk about customer experience, the challenges facing all parties and possible solutions.

Why Should Businesses and Social Sellers Use Credo?

Peace of mind. With Credo businesses and consumers will never have to worry about payments. Ever again.

Does the challenge of running a startup daunt her in any way? Adebunmi resolutely shakes her head and says the joy is in the adventure.

She has found the advantage of running a start-up is getting in all the best practices from ground up across all facets as you strive to get acquired or become a full fledged business. She believes it is the chance to build; learning and unlearning whilst effectively managing EVERYTHING be it Products, Operations, Engineering, Finances or Talent. More importantly, a chance to discern potential risk factors at the outset, and mitigate for wins and success.

As Credo is unveiled to an Africa that needs it, Adebunmi is pleased with the thoughtfulness, innovation and processes that have gone into creating this product. She is glad she stayed undeterred when there were naysayers who asked her to make her dream smaller.

“We were told it wasn’t feasible to create a product addressing all the pain points but here we are” she says with a smile. “We are everything you expect of a payment gateway and more – with our extra special social payment solution.”

Go Bunmi! We are here for this.

Credo does more than can fit into one article. To learn more about how you can grow your business with Credo, click here.

Let’s be friends! Say hello to us on our social media handles!

Credo on Twitter , Credo on Instagram, Credo on Linkedin, Credo on Facebook

Wow that was odd. I just wrote an really long comment but after I clicked submit my comment didn’t show up. Grrrr… well I’m not writing all that over again. Regardless, just wanted to say excellent blog!

Hi, just wanted to tell you, I enjoyed this article. It was inspiring. Keep on posting!

I do agree with all the concepts you’ve introduced on your post. They’re very convincing and can certainly work. Still, the posts are very brief for novices. Could you please prolong them a bit from next time? Thanks for the post.