As a business owner or manager, you’ve probably had moments when you wondered, “Should I be more open about how much the company makes?” It’s a tricky question, and there’s no easy answer. On one hand, transparency can build trust, foster a sense of ownership, and even boost performance. On the other, it can lead to misunderstandings, jealousy, and unnecessary stress.

Why Transparency Could Be the Best Thing You Ever Did

1. Trust Is the Foundation of Every Successful Business

Imagine this: you’ve got a team of hardworking people who give their all every day, but they have no idea how the business is really doing. They’re in the dark, guessing and assuming, which can lead to a whole lot of unnecessary stress and suspicion.

Now, what if they knew? What if they understood the highs and lows, the challenges and the victories? When you open up about the company’s finances, you’re not just sharing numbers—you’re building trust. And trust? It’s the glue that holds everything together. Employees who trust you are more likely to go the extra mile, stay loyal during tough times, and contribute ideas that could take your business to the next level.

2. People Perform Better When They Understand the Stakes

There’s something powerful about knowing exactly how your work impacts the bottom line. When employees see the connection between their efforts and the company’s revenue, they start to feel like they’re part of something bigger than just their job description.

It’s like being on a sports team where everyone knows the score and is working towards the same goal. When employees understand the financial stakes, they’re more likely to focus on activities that drive the company forward. This can lead to a performance-driven culture where everyone is striving to hit the same targets.

3. Financial Literacy Is Empowering

Let’s be real—money can be intimidating. But it doesn’t have to be. By sharing financial information with your team, you’re giving them the tools they need to understand how the business works. This isn’t just about boosting morale; it’s about empowering your employees to make smarter decisions.

When your team knows what’s at stake, they’re more likely to think twice before spending company resources or making big decisions. They start to see the bigger picture and how their actions fit into it. And that kind of awareness? It’s invaluable.

Why Transparency Could Be a Risky Move

1. Jealousy and Resentment Are Real

Here’s the flip side: when you open the books, you risk opening a can of worms. Not everyone on your team is going to interpret the numbers the same way. Some might see the company’s profits and wonder why they’re not getting a bigger slice of the pie. This can lead to resentment, jealousy, and even a decline in morale.

It’s human nature to compare, and when employees see how much the company is making, they might start to feel undervalued—even if their compensation is fair. This is especially true if the company is doing well, but there’s no corresponding increase in salaries or benefits. It’s a delicate balance, and one that needs to be handled with care.

2. Not Everyone Will Understand the Numbers

Another potential pitfall is the risk of misinterpretation. Financial data can be complex, and not everyone on your team will have the financial literacy to understand what the numbers really mean. A slight dip in revenue might be part of a normal cycle, but without context, employees might panic and assume the worst.

On the other hand, if they see large profits, they might think the company is flush with cash and start expecting raises or bonuses that aren’t in the cards. This can lead to unrealistic expectations and put management in a tough spot.

3. It Can Put Pressure on You as a Leader

Let’s not sugarcoat it—being open about finances can put a lot of pressure on you as a leader. Once you start sharing financial information, you may find yourself having to justify every decision, every dollar spent or saved. Employees might push for higher pay, more benefits, or other costly initiatives based on their understanding of the company’s earnings.

This added pressure can be draining, taking your focus away from other critical areas of the business. And in situations where the company is facing financial challenges, it can be even more stressful to manage employee expectations.

Finding the Right Balance

So, where does that leave you? Transparency doesn’t have to be all or nothing. It’s about finding the right balance that works for your business and your team.

Here’s how you can approach it:

1. Customize Transparency Based on Roles

Not everyone needs to know everything. One effective approach is to tailor the level of transparency based on roles and responsibilities. For example, your executive team might have full access to financial reports, while your frontline staff gets a more general overview.

This way, you’re sharing information in a way that makes sense for each role, reducing the risk of misunderstandings while still fostering trust. It also means that employees have the information they need to do their jobs well, without being overwhelmed by data they don’t need.

2. Educate Your Team on Financial Literacy

If you decide to share financial information, make sure your team understands it. This might mean providing some basic financial literacy training or holding regular meetings to explain what the numbers mean.

By educating your employees, you’re not just handing over data—you’re helping them see how their work contributes to the company’s success. This not only boosts morale but also encourages a more thoughtful, informed workforce.

3. Use Transparency as a Motivational Tool

Transparency doesn’t just have to be about sharing the numbers—it can be about inspiring your team. Consider tying transparency to a profit-sharing program or performance bonuses. When employees see a direct link between the company’s success and their own compensation, they’re more likely to stay motivated and engaged.

This approach aligns their interests with the company’s financial goals, creating a win-win situation for everyone.

How Credo Can Help You Navigate Transparency

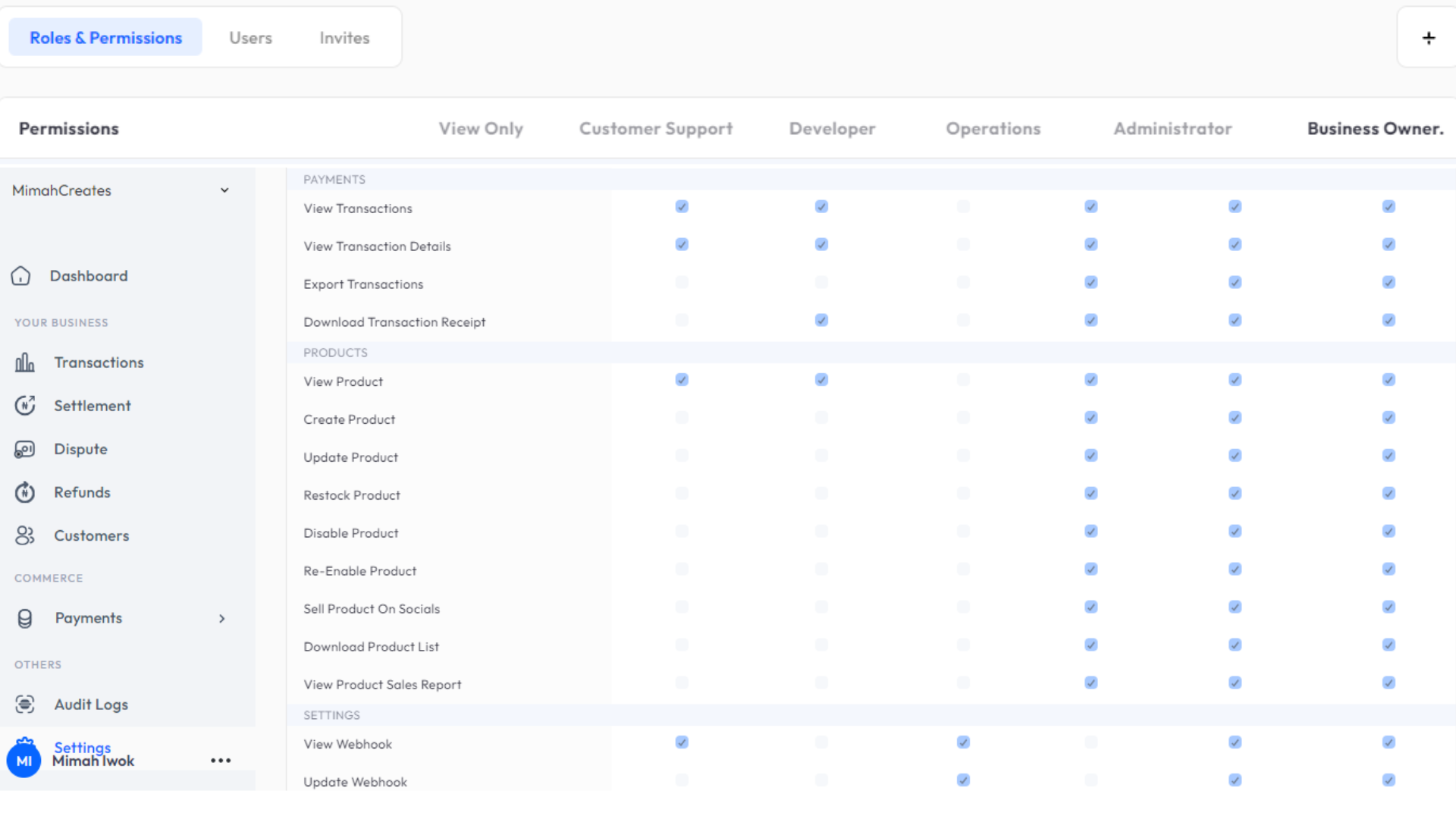

Managing transparency effectively requires the right tools. This is where Credo’s payment gateway comes in. With Credo, you can set up customizable roles and permissions that allow you to control who sees what.

1. Tailored Access with Customizable Roles

Credo lets you create custom roles for each employee or department, giving them access to the financial information they need—nothing more, nothing less. This means you can share detailed financial data with your CFO, while your sales team only sees what’s relevant to them.

This kind of tailored access helps you strike the right balance between transparency and security. You can build trust with your team without exposing sensitive information to everyone.

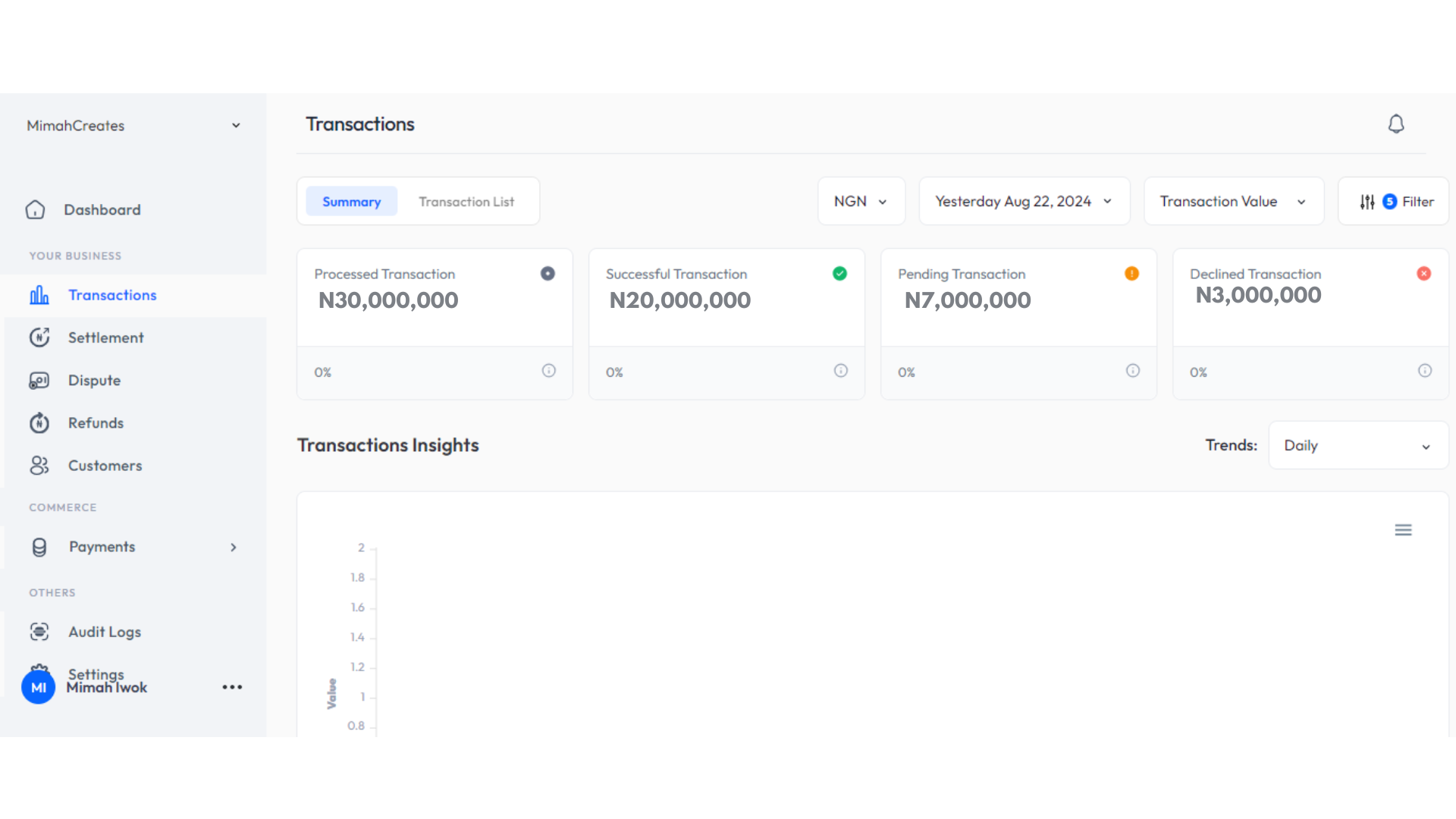

2. Easy-to-Understand Financial Reports

Credo’s platform makes it easy to generate financial reports that are clear and easy to understand. Whether you’re sharing high-level overviews or detailed breakdowns, Credo’s tools help you communicate effectively with your team.

These reports can be customized based on the needs of different departments, ensuring that everyone has the information they need to perform their best.

3. Security You Can Rely On

When it comes to financial transparency, security is key. Credo’s payment gateway offers top-notch security features to protect your data, including two-factor authentication and encrypted data storage.

You can confidently share financial information with your team, knowing that it’s protected by industry-leading security measures.

Final Thoughts: Make Transparency Work for You

The decision to share financial information with your employees is a big one, with both benefits and risks. By carefully considering your company’s unique situation and using tools like Credo to manage transparency, you can create an environment of trust, engagement, and performance.

Remember, transparency isn’t about sharing everything—it’s about sharing the right things with the right people. With Credo, you can navigate this complex issue with confidence, building a stronger, more connected team that’s ready to take your business to new heights.