Adapt or die.

These were the only options available to many businesses in 2020 when Nigeria was forced to go into lockdown like the rest of the world because of the pandemic. Retailers saw their businesses being shut down unless they innovated to survive.

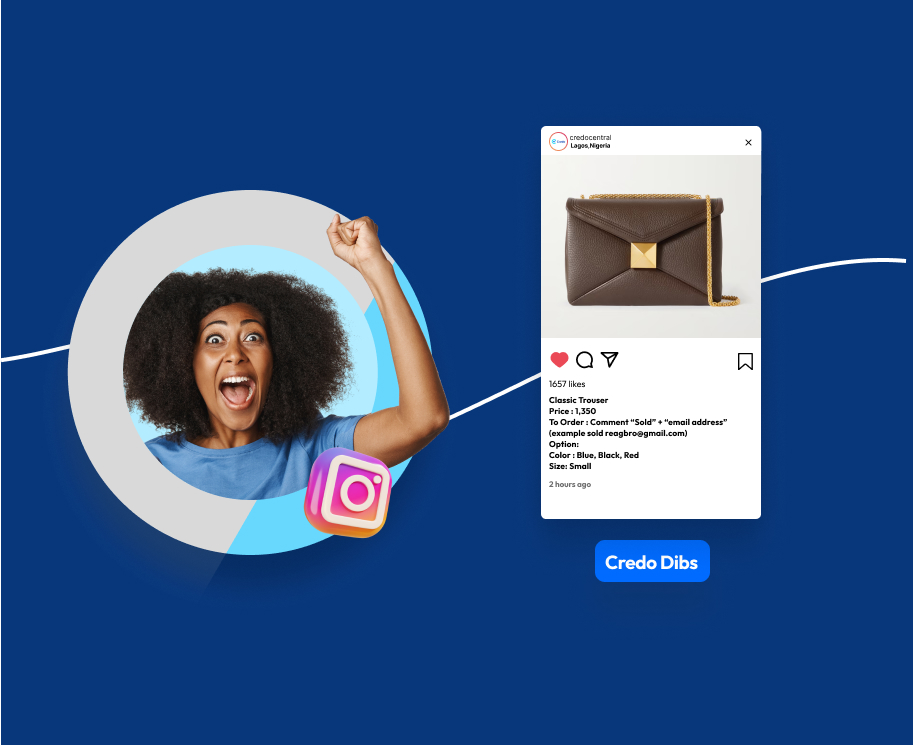

Consequently, turning to social commerce was a life-line for some Merchants. But this life-line was still found wanting – merchants and customers were plagued by digital payment challenges; a single transaction required as many as 4 or more different solutions (Social Media Network, Payment Solution, Communication channel etc) over multiple communication sessions and an untidy accounting and operation management system to be successful, making customer experiences undelightful and conversions harder.

What’s Social Commerce?

Social commerce is the use of a social network community to drive e-commerce sales, and it’s a massive market: By 2027, it’s projected that social commerce will drive $604 billion in sales.

Because of the extensive reach and crowded marketplaces, businesses of all sizes can succeed on the right social media platform.

Amid the COVID-19 crisis, the global market for Social Commerce was estimated at US$89.4 Billion in the year 2020 and is projected to reach a revised size of US$604.5 Billion by 2027, growing at a CAGR of 31.4% over the analysis period 2020-2027.

However, to fully take advantage of the opportunities of social commerce, merchants have to operate with consumer payment preferences in mind.

What is Social Payment?

Social payment is a means of payment that incorporates aspects of social media. Those involved in the transaction exchange usernames, phone numbers, or email addresses rather than financial information. Instead of cash, you can use a social payment enabled gateway to send and accept payments without sharing your bank account information.

Adaobi runs a retail store that received a lot of patronage pre-pandemic. People loved her wares of clothing, gift items and so on. Adaobi also realized that shoppers liked a sense of warmth and a place to relax and be at leisure, so she created a hangout spot by placing a sofa in the middle of the store. Her customers often stopped to chit chat and would buy something. Business was good until the pandemic hit.

Forced to shut down and go home, Adaobi decided it was the end of an era. Her customers used to come to her, now it was time to take the “market” to her customers. She took photos of her product and uploaded them on her social media handles. Customers could buy and she promised to deliver to their homes. Her strategy worked as the orders poured in and deliveries began, but she soon became overwhelmed by the process of posting on all her social media platforms, engaging customers, tracking orders, managing inventory and accepting payments. Once, she was defrauded by a customer after she got a fake credit alert. Other times, she delayed fulfilling customers’ orders because she could not confirm payments on time.

There are many Adaobis out there.

How Social Commerce is Changing the African Business Scene

Social commerce is a real, viable and growing form of e-commerce. As such, more entrepreneurs are adopting this as a business channel. Social commerce eliminates overheads like rent, the need for staff and so on.

For buyers, social commerce gives them an opportunity to interact with multiple brands at the same time. The customers engage with merchants and learn about them through comments and reviews shared by other customers. They can also compare prices with competitors before making a buying decision.

The Challenges of Social Commerce

Despite the benefits, social commerce is not without its own problems, payment is number one. A lot of the problems that come with social commerce have their solution in social payments. Social payments are digital payment methods that allow people to exchange money without sharing sensitive financial information. They are set up to enhance social commerce in ways that would benefit Merchants and their Customers. Consequently, an efficient social payment platform helps to provide credible marketplaces and a customized payment system that suits both the seller and buyers in the following ways:

Trust

Merchants gain greater trust when they sell via a credible social payment platform. Customers trust that the seller on a platform has been verified is not a random fraudster trying to make away with their money. With trust comes credibility, faster conversions and increased sales especially when great customer experience is added to the mix. Partnering with a reputable platform also reassures customers because your business leverages the platform’s reputation and features to make shopping, payment, dispute processes and even delivery seamless.

Visibility

When a merchant partners with a social payment platform, she is assured that her product awareness and visibility goes beyond her immediate social media following to include people she may not have otherwise reached. Viable social payment platforms provide a community where merchants and customers can connect, promote their goods with tools that help them get brand visibility to grow their business.

Efficiency

With features like comment selling, merchants free up time to perform other important tasks and allow automation to manage the process of posting, engaging customers, managing orders, accepting payments and processing invoices. This will improve conversions and efficiency, eliminate waste and make shopping enjoyable for customers.

Customer experience

Customers also enjoy the satisfaction of knowing that the social payment platform is dedicated to providing an excellent customer experience and they are encouraged to return again and again. When social shopping is digitized, and designed to be convenient, secure and seamless, customers will spend more time on a merchant’s page which increases the likelihood of them making a purchase.

Other Challenges of Social Payments include:

Security

Who guarantees the security of funds when a sale goes social? “My money don loss!” expresses a common sentiment for customers who try to make an online or social purchase and lose money. Social media is awash with these stories. Partnering with a secure social payment platform is critical in achieving success in social commerce. A secure platform ensures that merchants and customers’ money is safe irrespective of their payment method.

Privacy

Many merchants are wary about selling on social media because they do not want to give out their bank account details. Do you really want everyone to know which bank you do business with? With real risks like phishing and social engineering, it is dangerous for private information to fall into the hands of fraudsters. Smart social payment tools allow merchants to accept payments without sharing sensitive payment details by generating a payment link with as little or as much information. This payment link can be shared everywhere and with all customers.

Customer Experience

At every touchpoint, the buyer wants to be wowed or at least satisfied. Negative customer experiences discourage many potential customers from buying on social media. The buyer in effect asks, “When I buy on social media, can I be sure that I will receive what I paid for and enjoy the entire shopping experience?” The key is ensuring that your online experience matches your offline experience. From customer engagement, order processing and accepting payments, ensure shopping online for your customers is simple and at checkout give multiple payment options within a secure gateway.

Low Patronage

Customers are not the only ones who suffer from indecision on whether they should do business online, merchants do too. Merchants are aware of the advantages of selling on social media but often wonder if the effort is worth the returns. The merchant’s question is “How can I get them to know me, trust me and buy from me again and again?” There are two ways to achieve this:

- Create engaging content

- Create a seamless shopping experience

Create engaging content: Creating engaging premium content that answers the questions your target audience seeks is one of the most important elements of a successful content marketing strategy. Buyers are much more likely to research potential solutions to a problem online than rely on a sales person to guide them. Customer-centric content like these projects a brand as a trusted and authoritative source.

Create a seamless shopping experience: How seamless is it to shop from your online store? From enquiries, engagement, payment, payment confirmation and delivery, customers must have it simply, fast and secure without any glitches to have a delightful experience. A way to achieve this is to leverage smart tools that make social commerce delightful.

Why is Credo the better way to do Social Payments?

Credo was designed to solve typical, gnawing but overlooked challenges we face in payments as well carving out a long overdue solution/product for social payments. With Social Payments, Social Sellers or Merchants do not have to be present to complete a sale on a social medium. It’s intelligent, automated workflow, and features minimize their time & costs and maximize their operational capacity. Customers can complete purchases and checkout quickly using its unique comment selling feature.

With comment selling, Merchants can accept, track and confirm payments seamlessly and streamline business operations and tasks – cart management, invoicing, inventory, shipping in real time. Potential customers on social media often fail to complete the sale because of buyer distraction. Comment selling eliminates this problem and ensures the completion of a sale. Credo’s advanced feature also allows customers to get personalized product and lifestyle nudges on products that they may like based on their search and shopping history.

The possibilities Credo offers are limitless – merchants can create customized payment links and product pages to accept payments safely without divulging sensitive details while the product pages allow the customisation of the look and feel of a Merchant’s brand with the addition of a logo, colors and even text.

There are more benefits to why social sellers should jump on to Credo quickly. Small businesses do themselves a lot of good by signing up for social payments on the Credo platform.

To learn more about Credo’s social payment platform, click here or click here to set up your Credo account.

Say hello to us on our social media handles! Credo on Twitter , Credo on Instagram, Credo on Linkedin, Credo on Facebook

“My money don loss” Is a Nigerian saying that means, I have lost money,